On a dark winter’s night, what could be more engrossing than my latest tragifarce about energy firms, guaranteed toset spines tingling?

Act I

The scene is Stafford where KM’s elderly mother lives alone in a council house fitted with a smart prepayment meter. She was persuaded to switch to British Gas with the promise of “preferential rates” whereupon the meter stopped working.

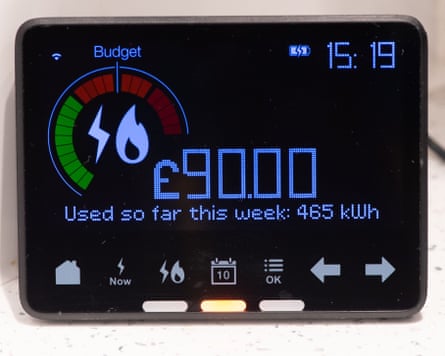

Because she can no longer monitor her credit or consumption, her electricity supply keeps cutting out. And since there is no gas supply to the house, that leaves her with no heating. She can’t pay on the app because that informs her that her account is locked.

“She gets different advice every time she rings,” says KM. One agent wants the pensioner to climb a ladder to photograph the meter number already on its records (she’s recently returned from a hospital stay).

Another tells her to use her old top-up card from her previous supplier. She does, after putting more money on it. Unsurprisingly it has no effect and she now faces clawing the money back from a supplier she no longer has an account with.

Eighteen days after the switch she can’t check what she’s paid for and she can’t keep warm.

British Gas’s conscience is always tenderised by a headline. It admits an unexplained “delay” in transferring her account which left her without heating three times in one chilly week.

It also admits a shortfall in customer service when she complained. It is now switching her to a credit meter, addressing the app issue and paying her goodwill for the “inconvenience”.

Act II

Up in Glasgow, RW has spent seven years telling his supplier that there is something wrong with his bills.

Ever since a new meter was fitted in 2018 they have been enormous. So enormous that he has been left with a four-figure debit several years on the trot because his ever-increasing direct debits can’t keep up. In vain, he has sent photos of his meter first to Bulb, then when it collapsed, Octopus Energy.

Both agreed there was something amiss, but since they couldn’t work out what they kept on helping themselves to RW’s money and RW kept getting into debt.

It was when he tried to switch supplier this year that the new company spotted the hitch: his meter readings had been recorded in cubic feet rather than cubic metres which means he has potentially been billed more than three times what he should have been.

Octopus promised to sort it out but the only contact RW has received in the weeks since has been more huge bills.

“I feel financially at the mercy of a company that really doesn’t care about me,” he laments.

Enter Guardian Money, and Octopus leaps into action.

It explains that the switch from an imperial meter to a metric one in 2018 was not recorded in the energy database, so his bills continued to be calculated in cubic feet. This has now been corrected and RW’s account has been reviewed and backdated.

The result? It was discovered he had overpaid more than £8,000. He’s since been refunded this plus interest calculated at 8% and compensation worth 10% – a total just short of £12,000.

Act III

We’re in Dorset where a teenage schoolgirl is being threatened with a trashed credit rating by Ovo. The utilities company has decided that she owes it £20.

The fact that the charges are for a rental property her family left a year ago and cover a period after they’d moved out is of no interest to Ovo. Its debt collectors inform her that she faces legal action if she doesn’t pay up.

This plot is spookily similar to my previous drama in which Ovo billed a teenage boy for a supply at an address he’d long since left.

Ovo won’t talk to the girl’s mother, GS, who was the account holder during the tenancy because of GDPR. It doesn’t think it’s odd that GS has a paid-up Ovo account for the family’s current home which was opened when they moved.

“How did our society get to the point where big businesses can threaten children over debts that aren’t theirs?” she asks. Ovo blames tracing agents, who match debts with creditors, who somehow got hold of the student’s details and matched them to a debt accrued between tenancies.

It has now cancelled the debt, deleted her details and dispatched a box of White Company lotions in contrition.

We welcome letters but cannot answer individually. Email us at consumer.champions@theguardian.com or write to Consumer Champions, Money, the Guardian, 90 York Way, London N1 9GU. Please include a daytime phone number. Submission and publication of all letters is subject to our terms and conditions.