By ROBERT FOLKER, NEWS REPORTER

Published: | Updated:

Aldi has revealed the location of 11 new stores it plans to open across the UK before the end of the year, on the same day it was beaten to the title of cheapest supermarket of the month.

The supermarket says it will open a total of one new store a week on average before the end of 2025.

Aldi said it is making a £650million UK investment this year, including refurbishing 35 current stores as well as the new openings.

The German-owned group, Britain’s fourth biggest supermarket, is recruiting for 1,000 store roles as it ramps up its store opening programme.

Currently, Aldi has more than 1,050 UK stores with a long-term goal of reaching 1,500 stores.

New stores opening in 2025 include locations in London, Liverpool, Leicestershire, East Sussex, Chesterfield, Kent, Durham, Tyne and Wear, Deeside and Caerphilly.

Jonathan Neale, Managing Director of National Real Estate at Aldi UK, said: ‘At Aldi, our goal is to make sure people across the UK have access to affordable, high-quality food, and opening new stores is key to making that happen.

‘We’re now opening an average of one new store a week for the rest of 2025, showing just how ambitious our plans are to build a store network that will help us reach millions of new customers.

It comes after the discount supermarket loses out on the top spot in the Consumer group Which?’s cheapest supermarket of the month for the first time in 20 months

11 new Aldi stores to open in UK in 2025

- Airfields, Welsh Road, Deeside

- Rockingham Road, Market Harborough, Leicestershire

- Fulham Broadway, London

- Pacific Drive, Eastbourne, East Sussex

- Mafon Road, Nelson, Caerphilly

- Ashford, Waterbrook, Kent

- Commercial Street, Shoreditch, London

- Philadelphia Lane, Houghton le Spring, Tyne and Wear

- Mill Road, Meadowfield, Durham

- Pendle Drive, Litherland, Liverpool

- Ringwood Road, Brimington, Chesterfield

After comparing a list of 76 items featuring both branded and own-brand items, including Birds Eye peas, Hovis bread, milk and butter, Aldi were pipped to the top.

The analysis includes special offer prices and loyalty prices where applicable, but not multibuys.

However, it has now been usurped by its German rival Lidl, where the shopping bill came to £128.40 on average across the month.

The price of the same shop at Aldi was 85p more expensive than its fellow discount supermarket.

The longer list at Asda cost £474.12, cheaper than Tesco with a Clubcard by £7.47 (£481.59).

In a longer list of 192 items, Asda remained cheaper than Tesco – even with a Clubcard.

The study of bigger shops does not include Aldi or Lidl because they do not always stock some of the products on the consumer group’s larger shopping list.

Waitrose was the most expensive on average, with the bigger shop costing £538.33 – a difference of £64.21 compared to Asda – 14 per cent more.

Waitrose was also the most expensive supermarket for a smaller list of items this month, totalling £170.91 on average.

This means shoppers would be spending £42.51 more on the same shop at Waitrose than shopping at Lidl with a loyalty card, a 34 per cent increase.

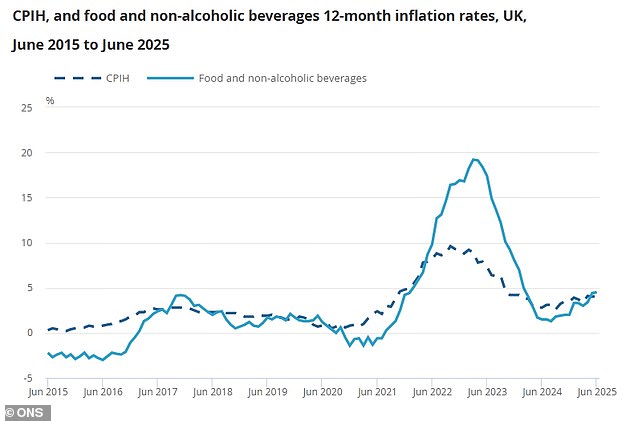

Families are said to be saving money by switching to simpler meals with own-brand products and fewer ingredients as grocery price inflation soared to an 18-month high.

The prices of foods including fresh meat, chocolate, butter and spreads are now rising the fastest, although costs are falling for dog food, sweets and laundry products.

The inflation rate hit 5.2 per cent for the four weeks to July 13 – its highest since January 2024, according to Worldpanel by Numerator, formerly known as Kantar.

Revenues at many supermarkets in the UK are benefiting from the price surge with take-home sales at the grocers growing by 5.4 per cent in the four-week period.

Lidl had a strong month as it hit a record high market share of 8.3 per cent, gaining 0.5 percentage points as it attracted more than 500,000 new customers to stores.

Britain’s biggest supermarket Tesco also did well as it boosted its share to 28.3 per cent as sales grew by 7.1 per cent, the fastest rate since December 2023.

Sales at Sainsbury’s increased by 5.3 per cent, putting its market share at 15.1 per cent – while grocery sales at M&S were 6.5 per cent higher than a year ago.

Sales at the UK’s fourth largest grocer Aldi increased by 6.3 per cent, bringing its share to 10.9 per cent. Aldi overtook Morrisons in autumn 2022, with the latter seeing sales nudge up by just 1.0 per cent and it now holds 8.4 per cent of the market.

Ocado retained its place as the fastest growing British grocer as its sales rose by 11.7 per cent, exceeding the overall online market growth rate of 5.7 per cent.

Online accounted for 12 per cent of all sales at the grocers over the past 12 weeks, with 23 per cent of households making at least one virtual shopping trip.

But Asda saw its market share fall one percentage point from 12.8 per cent to 11.8 per cent; while Co-op’s share dropped half a percentage point from 5.7 per cent to 5.2 per cent.