THEY were once the “Big Three”.

A trio of clubs that were the Prem’s dominant forces, not only on the pitch, but off it too.

Yet while Arsenal’s season could still end with the ultimate sporting glory in Munich next month, and they are set to reap the financial rewards this sumer and beyond, it could be a potentially very different scenario at both Chelsea and Manchester United.

Instead of a summer of acquisition to take them to the next level, it could be one of retrenchment.

Belt-tightening that cannot be dodged.

And a summer of sales first, cut-price arrivals later – merely to help balance the financial scales.

The contrast between the three clubs could not be wider on the pitch – or among the fans.

If there were any Arsenal fans still questioning Mikel Arteta over the imminent reality of a third successive second-place Prem finish, so near to the summit but unable to get there, they were surely ended in Madrid last week.

That win in the Bernabeu, setting up next week’s semi-final first leg clash with PSG and putting Arsenal 270 minutes away from conquering Europe’s highest peak was a financial victory, too.

Last season, Arsenal delivered record revenues of £616m, with “football revenues” up almost £150m on the previous year.

Much of that was down to the club’s return to the Champions League, a run that was ended by Harry Kane’s Bayern, bringing total income from TV-related prize money to £262.3m.

In addition, the extra European matches meant more home games, with Arsenal earning £131.7m through the gate, while commercial performance from the club’s growing list of sponsors and partners rose to a record £218.3m.

Those income streams have a direct impact on the club’s books and their ability to comply with both the Prem’s PSR and Uefa’s sustainability rules.

And this season, already, it is clear that those revenue streams are only going to have gone in the right direction.

Arsenal have already banked £98.7m from their Champions League run, a sum that could rise by a further £21.5m if they go on to lift the trophy in the Allianz Arena.

They will again earn in the region of £175m from the Prem’s various broadcasting deals both domestically and overseas but are already guaranteed almost £25m more from their European exploits than last term.

But the run to the semi-finals means an extra two European home games than in 2023-24, while they have also had three home Carabao Cup games, compared to none last term.

Even with reduced gate prices on two of those Carabao Cup matches, it is likely to see turnstile income closing in on £150m.

And the on-field success means all the existing commercial deals will be paid in full, while Arsenal also unveiled a “multi-year” arrangement with Japanese tech company NTT Data, understood to be worth £4m per season.

It all adds up to likely revenues in excess of £650m for the season as well as a guarantee, without kicking a ball, of £50.3m from the Champions League next term.

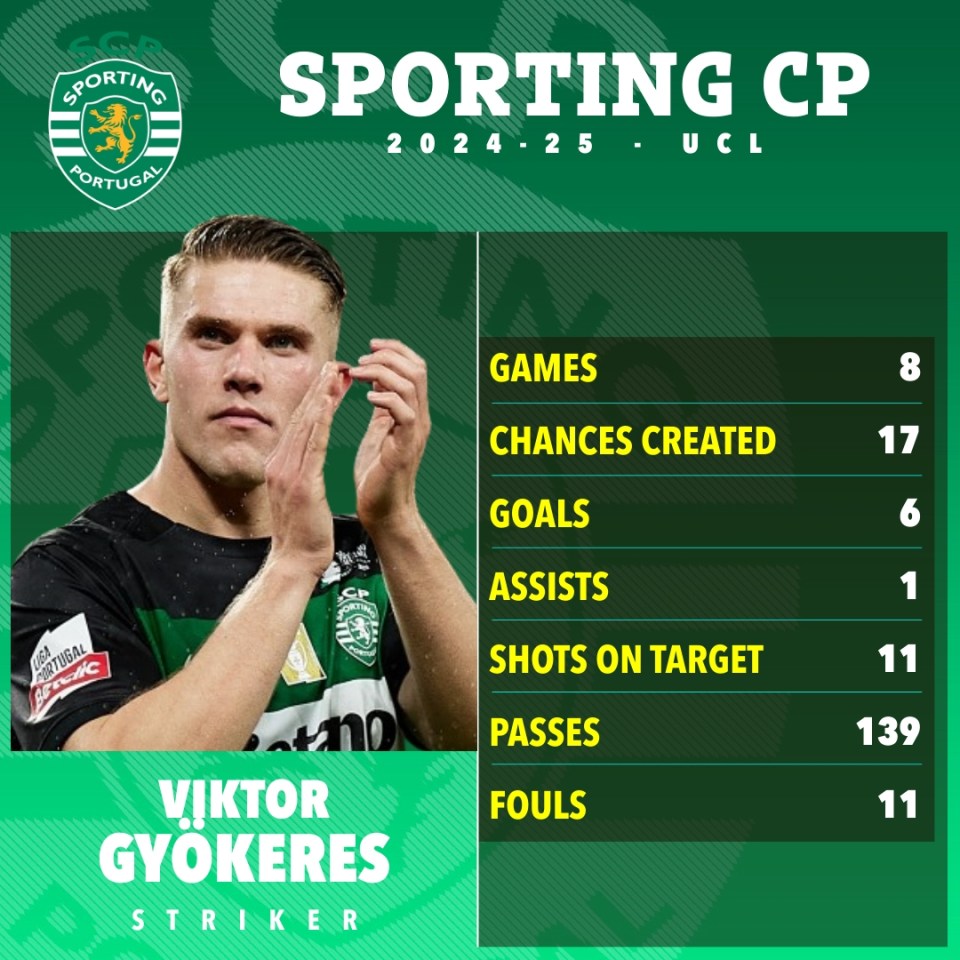

That means additional funds set to be available for Arteta to use for his recruitment drive, with a top-class centre-forward, expected to be either Sporting’s Viktor Gyokeres or Benjamin Sesko of Leipzig, the priority – but a deal that Arsenal can easily afford.

Yet things are looking very different for both Chelsea and United – with the pressure on both Enzo Maresca and Ruben Amorim to plot their very different routes into the Champions League being absolutely immense.

Harry Maguire’s last-gasp goal against Lyon, completing one of the all-time Old Trafford comebacks, will become the stuff of legend if United go on to beat Bilbao in the semi-final and then triumph against Spurs or Bodo/Glimt back in the Basque city next month.

But United’s new owners Ineos, determined to try and make the numbers add up, are likely to be more concerned with the financial bottom line if a season to forget ends with a Europa Cup win to remember.

That bottom line will run to nine figures, as well.

United have banked around £21.6m from their run to the semis, with a further £11.2m on offer plus the chance to play in August’s Uefa SuperCup, worth a minimum of £3.1m.

Qualifying for next season’s Champions League will be worth £49m up front – by virtue of the TNT and Prime Video Uefa deals and United’s high position in the five and 10-year coefficient tables – plus giving four home games – worth another £20m through the gate.

Failing to qualify for Europe at all means none of that money will be available, while United will also see £10m deducted from their payments from kit suppliers Adidas as part of a penalty clause in the agreement.

And with a bottom-half Prem finish seemingly nailed on, United’s earnings from the league are likely to drop to £135m from £156m last term.

Putting those numbers together and the need for Champions League football for a club that has already launched a major cost-cutting drive is crystal clear.

Without that ticket back to the elite, Amorim’s summer options will be even more limited, heightening the need to sell players – including some he would prefer to keep.

Likewise at Chelsea, where Maresca’s popularity with the fans seems to be in freefall – despite Sunday’s late drama at Fulham.

Nottingham Forest’s win at Spurs means Chelsea go into the last five matches of the season in sixth place.

Their fixtures are tough, too – although it does leave things in their own hands.

After Saturday’s home game with Everton, the Blues host Liverpool, travel to Newcastle, welcome United to the Bridge and then go to Forest on the last day of the season.

The Conference League semi-final against Swedes Djurgarden offers the prospect of silverware but the prize is not that great as there is a huge chasm between the rewards of the Europa League and the main competition – upwards of £70m.

As with United, Chelsea’s Uefa coefficient means they would be in line for a massive pay-day – of £48.8m – just for qualifying, although gate receipts at Stamford Bridge are significantly less with the capacity of just 44,000.

Missing out, though, would hurt, even though Chelsea will earn £30m up front – and a potential further £67m for going all the way – from this summer’s Club World Cup exertions, likely to have a detrimental impact on their performances at the start of next term.

The club has managed to avoid PSR issues as far as the Prem is concerned by the internal sales of two hotels at Stamford Bridge and the all-conquering women’s team – although the account book value of £200m for Sonia Bompastor’s side is unlikely to be agreed in full.

But Uefa have refused to accept either deal, meaning fines are looming for both last term and this season – which will again knock a hole in the financial slate.

And the astonishing £1bn-plus spending since the Todd Boehly-led takeover in 2025 means Chelsea have huge annual “amortisation” costs – money owed on transfer fees – of more than £300m plus a massive wage bill to factor into the balance sheet.

Without Champions League football, and with few remaining non-football assets available to sell, a reckoning is likely, pretty soon.

And that would make the Arsenal smiles even wider.

Join SUN CLUB for the Arsenal Files every Friday plus

in-depth coverage and exclusives from The Emirates